Imagine this: You’re a freelance superhero😎, completing tasks and earning epic rewards. But before you celebrate with a victory dance, there’s one tiny hurdle – the W-9 form. Think of it as your hero registration. It helps track your earnings and ensures you receive the recognition you deserve.

Here’s the good news:😃 filling out the W-9 doesn’t require superpowers, just a few simple steps. Let’s break it down and turn tax form frowns upside down!

Now, grab your trusty pen (black ink only, remember!) and get ready to conquer the W-9 with this easy-to-follow guide. We’ll be superheroes in no time!

✍Step 1: Gather your information

Before you start filling out the form, you’ll need to gather some information about yourself or your business. This includes:

- Your name (or business name)

- Your address

- Your Taxpayer Identification Number (TIN). This could be your Social Security number (SSN), employer identification number (EIN), or individual taxpayer identification number (ITIN).

✍Step 2: Find the right form

There are two versions of the Form W-9:

- Form W-9 is for U.S. persons.

- Form W-8BEN is for foreign persons.

Make sure you’re using the correct form for your situation.

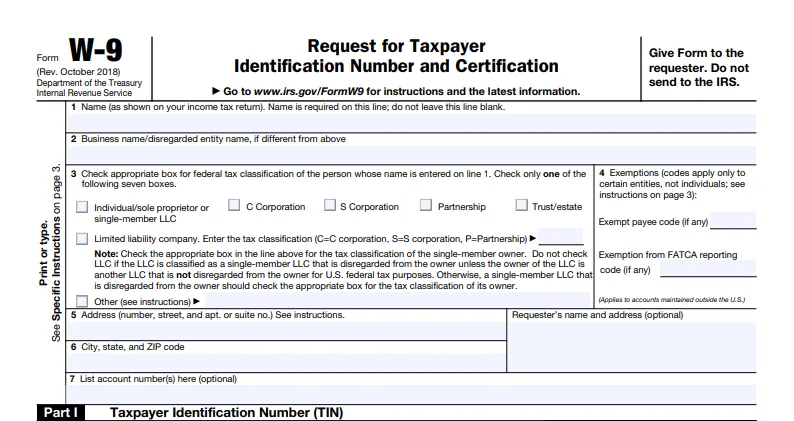

✍Step 3: Fill out the form

The form is pretty straightforward, but here are some tips for filling it out:

- Line 1: Enter your name (or business name) exactly as it appears on your tax return.

- Line 2: Check the box that describes your tax classification (e.g., individual, sole proprietor, corporation).

- Lines 3–5: Enter your address.

- Line 6: Enter your TIN.

- Line 7 (optional): If you’re exempt from backup withholding, you can enter your exemption code here.

- Lines 8–9: If you’re a foreign person filling out Form W-8BEN, you’ll need to fill out these lines to provide information about your foreign tax status.

- Sign and date the form.

✍Step 4: Submit the form

Once you’ve filled out the form, you’ll need to submit it to the person or business who requested it. They will use the information on the form to report any income they pay you to the IRS.

Here are some additional tips for filling out the Form W-9:

- Use a black pen.

- Print clearly.

- Don’t leave any blanks blank. If a question doesn’t apply to you, write “N/A”.

- Double-check your information before you submit the form.

I hope this helps!

That’s it guys. If you found this article helpful, consider subscribing to my newsletter here.❤️️ So, you will get the most updated tricks and techniques to be successful in writing.